The world doesn’t just buy drugs-it buys them from Asia. In 2024, India supplied over 60% of all generic vaccines and 40% of the U.S. generic drug market. Meanwhile, China controlled 70% of the global supply of Active Pharmaceutical Ingredients (APIs), the raw building blocks of nearly every pill you take. These aren’t just numbers-they’re the backbone of affordable healthcare for billions. But behind the scale lies a complex, shifting battlefield where cost, quality, regulation, and innovation collide.

India: The Volume Champion with a Quality Challenge

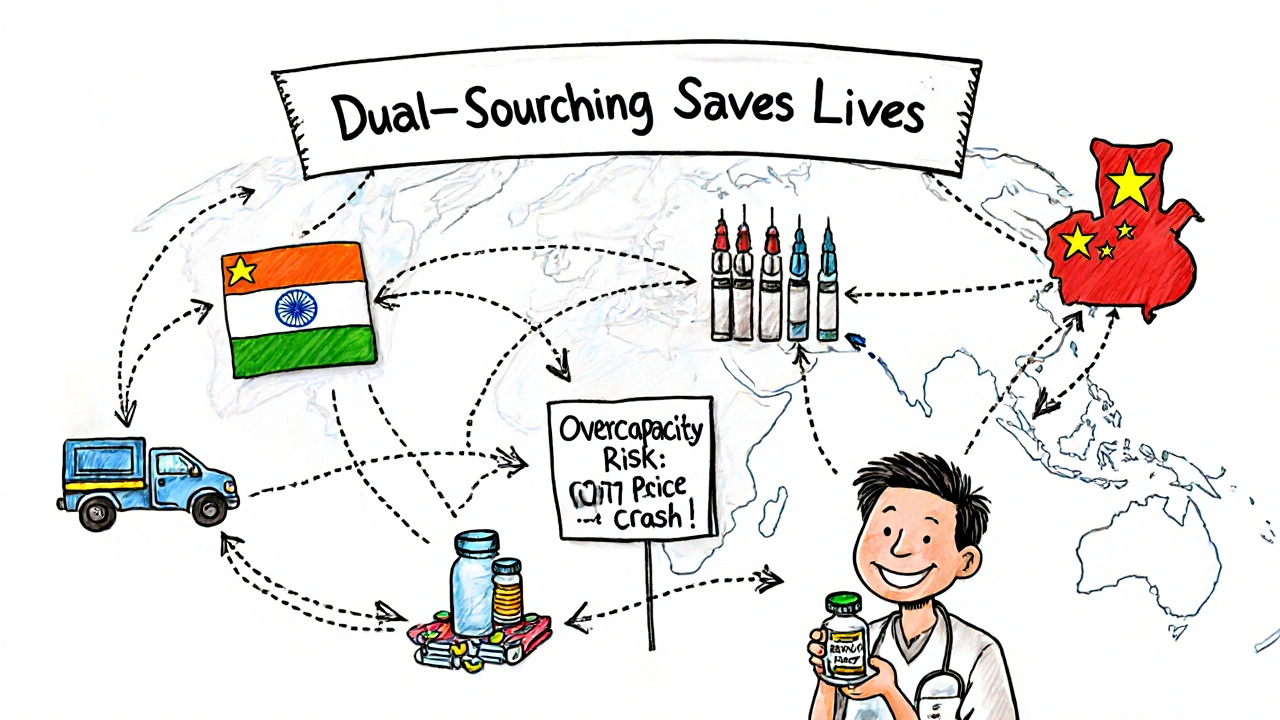

India’s rise as the "pharmacy of the world" wasn’t luck. It was policy. In the 1970s, after changing its patent laws to allow only process patents-not product patents-Indian companies could legally copy any drug formula as long as they made it a different way. That opened the floodgates for cheap generics. Today, India produces 75% of its pharmaceutical output as conventional generics, mostly small-molecule drugs for blood pressure, diabetes, and infections. The numbers are staggering. India has over 3,000 FDA-approved manufacturing sites, more than any country except the U.S. Gujarat and Maharashtra together make up 60% of that output. But here’s the catch: only 15% of those facilities can handle advanced biologics. Most still churn out low-margin pills using older tech. That’s why India ranks 3rd globally in volume but only 14th in market value. Its biggest weakness? Dependence on China. Despite spending billions on "Pharma Vision 2020" and now "Pharma 2047," India still imports 68% of its APIs from China. That’s a strategic vulnerability. When China restricts exports-even temporarily-Indian drugmakers feel it. A single port delay in Shanghai can ripple through hospitals in Texas. On the flip side, Indian companies are known for flexibility. If a U.S. pharmacy chain needs a custom tablet formulation, Indian manufacturers often deliver in 14 days. Chinese suppliers? 30 to 45 days. And customer service? Indian firms score 4.3 out of 5 on communication, compared to China’s 3.7. That’s why 68% of major U.S. pharmacy chains now split their generic sourcing between India and China-to get the best of both.China: The Value Powerhouse with Quality Scrutiny

China’s story is different. It didn’t start as a drugmaker. It started as a chemical factory. For decades, China produced APIs-raw ingredients-at rock-bottom prices. Today, it’s not just making ingredients. It’s making high-value biologics, biosimilars, and even some novel drugs. In 2024, China’s pharmaceutical market hit $80.4 billion, bigger than India’s $61.36 billion, even though India exports more volume. China’s manufacturing hubs in Jiangsu, Zhejiang, and Shanghai are now packed with state-of-the-art biologics plants. Between 2020 and 2024, 45% of all new pharma facilities built in China were for biologics. That’s not an accident. The government poured $150 billion into innovation under its 14th Five-Year Plan, with 40% going straight to R&D for complex drugs. But quality control remains a headache. In 2024, the U.S. FDA issued 142 warning letters to Chinese manufacturers-almost twice as many as India’s 87. These aren’t minor slips. They’re about falsified data, unclean facilities, and unapproved changes in production. One German healthcare company told Procurement Today they had to double their batch testing after a Chinese API batch failed in 2023. That added 18% to their supply chain costs. Still, China wins on price. Its API prices are 20% lower than India’s on average. And its approval process is faster: 12-18 months for foreign companies versus India’s 18-24 months. China also has fewer regulatory bodies to navigate-just eight national agencies versus India’s 17 federal and state-level ones. That’s why many global buyers still rely on China for bulk API, even if they turn to India for finished products.

Emerging Economies: Niche Players, Big Potential

While India and China fight for dominance, smaller countries are carving out survival niches. Vietnam, for example, grew its pharmaceutical exports by 24.7% in 2024 to $2.8 billion-mostly in antibiotic intermediates. It’s not making finished pills yet, but it’s making the key chemical steps that go into them. That’s smart. It avoids direct competition with giants and plays to its strengths: lower labor costs and ASEAN trade deals. Cambodia is doing something even more unexpected. It’s not making drugs at all. It’s assembling medical devices-glucometers, IV drips, pulse oximeters-with 18% annual growth. With low tariffs under ASEAN agreements and minimal regulatory barriers, it’s becoming a hidden hub for low-cost, high-volume medical hardware. These countries aren’t replacing India or China. They’re filling gaps. When global buyers need a specific antibiotic intermediate or a batch of disposable syringes, they now have options beyond the two giants. That’s reducing risk. It’s also forcing India and China to upgrade-not just in scale, but in specialization.Who Wins in the Long Run?

India’s advantage is its people. Two-thirds of its population is under 35. That’s a huge domestic market for drugs, and a massive talent pool for R&D. Its digital health investments-$2.8 billion in 2024 alone-are starting to pay off. Startups are building AI tools to predict drug demand and blockchain systems to track medicine supply chains. If India can turn this demographic energy into innovation, it could close the gap with China by 2035. China’s advantage is capital and scale. It’s not just making more drugs-it’s making more valuable ones. By 2030, China aims for 25% of its pharmaceutical exports to be high-value biologics. That’s up from just 8% in 2024. That shift means higher margins, less price pressure, and more global influence. Even if its growth rate slows, the dollar value it adds will keep rising. But both face the same threat: overcapacity. S&P Global Ratings warns that by 2026-2027, too many API plants will be running at low capacity, triggering a 15-20% price drop. That’s bad news for investors but good news for hospitals and patients. It could make generics even cheaper-unless quality collapses under the pressure.

What This Means for Buyers and Patients

If you’re a hospital administrator, a pharmacy chain, or even a patient buying generic meds, here’s what you need to know:- India is your go-to for fast, flexible, finished generic drugs. Good for urgent needs, custom formulations, and strong customer support.

- China is your go-to for bulk, low-cost APIs and high-end biologics. Best for large-volume, long-term contracts where price matters more than speed.

- Vietnam and Cambodia are your backup options for niche components. Not for everything-but they reduce your risk if the big two stumble.

Final Reality Check

There’s no single winner here. India wins on volume, speed, and customer service. China wins on scale, price, and innovation potential. Emerging economies win on agility and niche focus. The real winner? Patients. Because as these countries compete, prices drop. Access expands. And more people get the medicines they need. The challenge isn’t choosing one country over another. It’s understanding how they fit together. The future of affordable medicine won’t be made in one factory. It’ll be built across a network-from Gujarat to Jiangsu, from Hanoi to Phnom Penh. And the companies that learn to navigate that network will lead the next decade of global health.Why does India export more generic drugs than China, but China has a bigger pharmaceutical market?

India exports more because it focuses on high-volume, low-cost finished generic pills-like antibiotics and blood pressure meds-that go straight to hospitals and pharmacies worldwide. China, meanwhile, makes more APIs and high-value biologics, which are sold at higher prices but in smaller volumes. So while India ships more pills, China earns more dollars per unit. China’s market size includes domestic sales, which are huge, while India’s market is more export-driven.

Is it safe to buy generic drugs from India or China?

Yes-if they’re approved by major regulators like the FDA, EMA, or WHO. Over 3,000 Indian facilities and hundreds of Chinese ones are FDA-approved, meaning they meet global safety standards. However, China has had more FDA warning letters due to data integrity and sanitation issues. The key is to buy from suppliers with proven compliance records, not the cheapest bid. Many global buyers now use dual-sourcing to reduce risk.

Why does India rely on China for active ingredients?

India has focused on manufacturing finished drugs, not the raw chemicals (APIs) that go into them. Building API plants requires heavy investment in chemical engineering, environmental controls, and complex supply chains. China built those capabilities decades ago and now dominates the global API market at 70%. Despite India’s "Pharma 2047" plan to cut API imports from 68% to 30% by 2030, it will take years and billions in new infrastructure to catch up.

Are emerging economies like Vietnam and Cambodia a threat to India and China?

Not directly. They’re not trying to replace India or China. Instead, they’re filling gaps India and China ignore-like producing specific antibiotic intermediates or assembling low-cost medical devices. These countries benefit from lower labor costs and trade deals like ASEAN, making them ideal for niche, high-volume, low-complexity products. Their growth helps global buyers diversify supply chains, which indirectly pressures India and China to improve efficiency and quality.

What’s the biggest risk to the global generic drug supply right now?

Overcapacity. Both India and China are building more API and drug manufacturing plants than the market needs. S&P Global warns this could trigger a 15-20% price drop in APIs by 2027, which sounds good for buyers-but it could force smaller manufacturers out of business. That could lead to quality cuts, supply shortages, or consolidation that reduces competition. The real danger isn’t too little supply-it’s too much supply with falling standards.

Latrisha M.

November 15, 2025 AT 22:13It's fascinating how supply chains have evolved into this intricate dance between cost, control, and compliance. The fact that India handles finished goods while China dominates APIs isn't just economics-it's strategic specialization. Buyers who understand this can build resilient systems without overpaying for redundancy.

Diane Tomaszewski

November 17, 2025 AT 08:29People forget that medicine isn't just about who makes it but who can deliver it safely and consistently. The real win here is that more people have access because competition forced prices down. Simple as that.

Oyejobi Olufemi

November 17, 2025 AT 21:23Let’s be real-this whole system is a rigged game. China controls the raw materials, India controls the final product, and the West? They just pay and pretend they’re in charge. Meanwhile, the FDA’s warning letters are just theater. They know what’s happening and they look the other way because they need the pills. This isn’t healthcare-it’s corporate colonialism.

Rachel Wusowicz

November 18, 2025 AT 18:36Okay, so... let me get this straight: China makes the actual medicine, India packages it, and then we all pretend it’s safe because the FDA says so?? But wait-didn’t China get 142 warning letters last year?? And India still imports 68% of its core ingredients from them?? So... we’re trusting a system where the foundation is built on a country that falsifies data... and the middleman is dependent on that same country?? And you call this a supply chain?? I’m not paranoid-I’m just good at math. And also... why are we still buying this???

Daniel Stewart

November 19, 2025 AT 08:41It’s interesting how we frame this as a battle between nations, when really it’s a reflection of global capitalism’s structural flaws. We optimize for cost, not resilience. We reward scale, not sovereignty. And we celebrate efficiency while ignoring the human cost of dependency. The real question isn’t who wins-it’s whether we’re willing to pay the price for convenience.

David Rooksby

November 20, 2025 AT 13:46Oh wow, so China’s got 70% of APIs and India’s got 60% of vaccines? That’s not dominance-that’s a monopoly with a side of delusion. And let’s not forget the 45% of Chinese facilities that got slapped by the FDA for falsifying data. Meanwhile, India’s running on 1980s tech and still thinks they’re the pharmacy of the world? Please. The only reason they’re competitive is because they’re still using sweatshop labor and ignoring environmental regulations. And don’t even get me started on how Vietnam’s quietly building a shadow supply chain under ASEAN’s nose. This isn’t pharma-it’s a geopolitical thriller written by a corrupt bureaucrat with a spreadsheet.

Jamie Watts

November 21, 2025 AT 13:53India’s got the volume but China’s got the future. Biologics are where the money is and China’s pouring billions into it. India’s stuck making aspirin and metformin while China’s building mRNA factories. The game changed. India’s still playing checkers while China’s playing 4D chess. And don’t even get me started on how they’re using AI to predict demand and blockchain to track every pill. You think you’re saving money buying Indian generics? You’re just delaying the inevitable. The future is Chinese-made precision medicine. Get used to it.

Deepak Mishra

November 23, 2025 AT 05:36OMG I JUST REALIZED SOMETHING!!! 🤯 India is like the Uber driver and China is the app owner!!! Like... India delivers the pill but China owns the recipe!!! And Vietnam? They’re the guy who fixes the GPS!! 😭😭😭 I’m crying because this is so deep!! And the FDA?? They’re just the traffic cop who keeps getting bribed!!! 🚔💸 #PharmaTruth #IndiaVsChina #SupplyChainDrama

Teresa Smith

November 25, 2025 AT 01:35Let’s be clear: the real threat isn’t China or India-it’s complacency. When hospitals and pharmacies choose based on price alone, they’re not saving money-they’re gambling with lives. The solution isn’t isolationism or nationalism. It’s accountability. Transparency. Investment in traceability. If we want safe, affordable medicine, we need to fund the systems that make it possible-not just buy the cheapest pill on the shelf.

Ankit Right-hand for this but 2 qty HK 21

November 26, 2025 AT 12:51India thinks it’s the pharmacy of the world? LOL. They can’t even make their own APIs and still call themselves a pharma giant? Pathetic. China built its empire with state-backed capital and discipline. India? They copied formulas and called it innovation. Now they’re begging for foreign investment while their infrastructure crumbles. This isn’t competition-it’s a funeral march with a flag.

ZAK SCHADER

November 26, 2025 AT 12:56USA needs to stop buying junk from China. India’s fine. We should ban Chinese pharma. End of story. Our people are dying because of this crap. Why are we letting them control our medicine? This is national security. Make it in America. Or at least make it in India. Not China. Never China.

Dan Angles

November 27, 2025 AT 17:56The structural dynamics described here reflect a global division of labor shaped by historical policy decisions, capital allocation, and regulatory evolution. India’s export-oriented model, rooted in process patent liberalization, enabled rapid scale but constrained technological advancement. China’s state-driven industrial policy, conversely, prioritized vertical integration and high-value innovation. The emergence of ASEAN-based intermediaries indicates not disruption, but diversification-a logical response to systemic risk. The challenge moving forward is not to choose between actors, but to institutionalize traceability, quality assurance, and strategic redundancy as non-negotiable pillars of global health infrastructure.

Danish dan iwan Adventure

November 28, 2025 AT 20:21India’s API dependency is a strategic failure of epic proportions. Pharma 2047? A fantasy. Without API sovereignty, you’re not a pharmacy-you’re a distributor. The 3,000 FDA-approved plants? Mostly repackagers. Real pharma is synthesis, not tablet pressing. China controls the molecular backbone. India controls the placebo packaging. Wake up.

John Mwalwala

November 30, 2025 AT 00:35Here’s the real conspiracy: the FDA doesn’t have enough inspectors to check all these plants. So they rely on self-reported data. China and India both know this. That’s why the warning letters are just PR theater. The real power isn’t in manufacturing-it’s in controlling the audit system. Whoever controls the paperwork controls the medicine. And guess who’s writing the rules? Not the patients. Not the doctors. The corporations. And they’re laughing all the way to the bank.

Melanie Taylor

December 1, 2025 AT 05:16OMG I just learned so much!!! 🌏💊 India = fast & friendly, China = cheap & complex, Vietnam = secret weapon!! 🙌 I never realized how much goes into a simple pill!! This is why we need to support global diversity in pharma-not just for price, but for resilience!! Also, can we please make a documentary about this?? I’d watch it on Netflix with popcorn!! 🍿❤️ #PharmaAwareness #GlobalHealthHeroes