When you’re packing for a trip abroad, you probably think about clothes, chargers, and maybe a good book. But do you think about what happens if you get sick and need your medication? If you’re taking regular prescriptions-like blood pressure pills, insulin, or thyroid medicine-you’re not just at risk of running out. You’re also at risk of facing a medical bill that could cost thousands, especially in countries like the U.S., where a single doctor visit can run $300 and a prescription might cost $200 out of pocket.

Most standard health insurance plans, including Medicare, don’t cover you overseas. Even if your plan covers emergency care abroad, it won’t pay for your daily meds. That’s where travel insurance with medication coverage comes in. But not all policies are created equal. Some promise protection but leave you holding the bag when you need your prescriptions filled.

What Travel Insurance Actually Covers for Medications

Good travel insurance covers new, unexpected illnesses or injuries that happen while you’re away. That means if you get pneumonia in Rome or twist your ankle in Bali, the policy will pay for antibiotics, painkillers, or other necessary meds prescribed by a local doctor. Coverage limits vary, but top plans offer between $5,000 and $250,000 for medication costs during your trip. Some even let you use network pharmacies like CVS or Walgreens in the U.S. with direct billing.

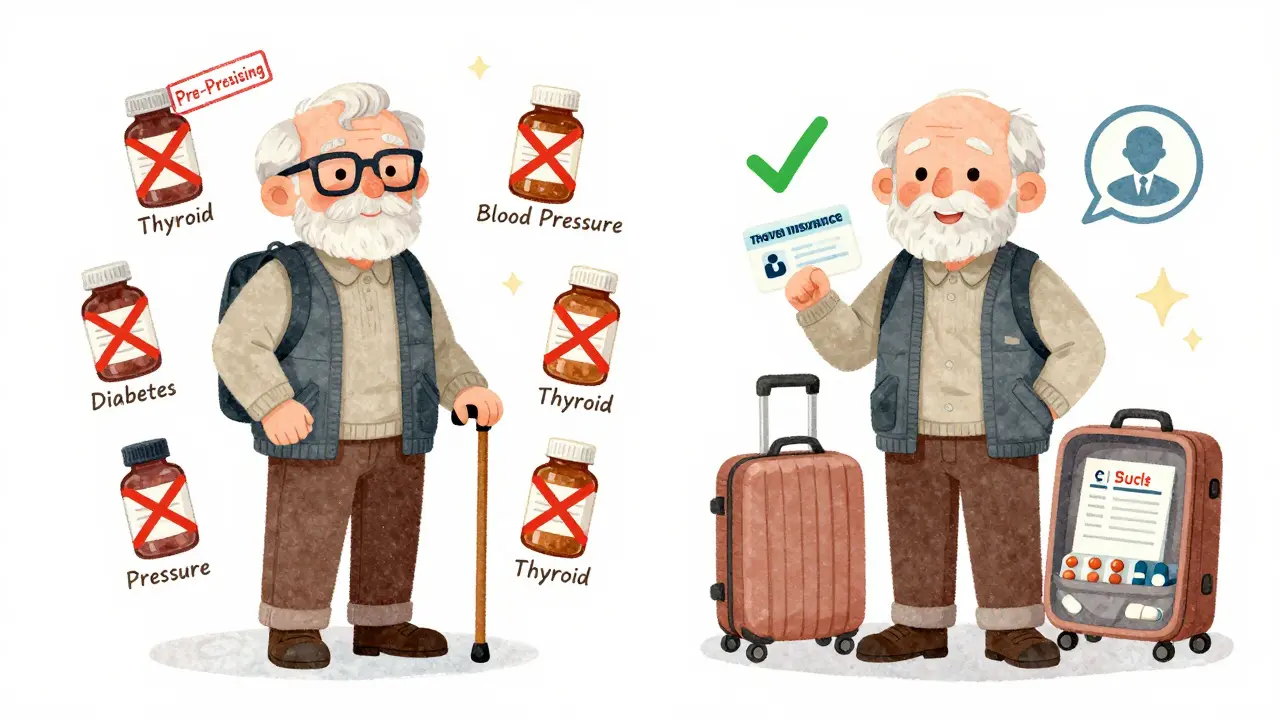

But here’s the catch: it doesn’t cover your regular, daily medications. If you forget your heart medication at home or lose your inhaler in Paris, most policies won’t replace it. That’s because these are considered pre-existing conditions or maintenance medications. Insurance companies treat them like routine expenses-not emergencies. So if you rely on daily drugs, you must bring enough for your entire trip plus a few extra days. No exceptions.

How Much Coverage Do You Really Need?

Medical costs abroad can explode fast. In the U.S., a hospital stay for a broken bone can cost $10,000 or more. Add in antibiotics, pain meds, and follow-up visits, and you’re looking at $15,000 before you even get home. The average medical claim for travelers is around $15,000, according to industry experts. That’s why most advisors recommend a policy with at least $50,000 in medical coverage. For longer trips or those with higher risk, $100,000 to $250,000 is smarter.

Medication limits are usually bundled under the overall medical coverage. So if your plan has a $100,000 medical limit, and you spend $20,000 on hospital care, you only have $80,000 left for meds and other treatments. Always check the fine print. Some plans list a separate medication cap-like $5,000 max for prescriptions. That might sound like a lot, but if you need specialty drugs, it can disappear fast.

Deductibles, Co-Insurance, and How Payouts Work

Travel insurance isn’t free coverage. You pay a deductible first-usually $0 to $2,500-before the insurer starts paying. Then, most plans use an 80/20 co-insurance split. That means after your deductible, you pay 20% of the remaining bill, and the insurer pays 80%.

Example: You need a $10,250 prescription and hospital visit. Your deductible is $250. You pay that first. Then, 80% of the remaining $10,000 is covered ($8,000). You pay the other 20% ($2,000). Total out-of-pocket: $2,250. That’s still a lot, but it’s far better than paying $10,250 yourself.

Some plans offer 100% coverage after the deductible-those are rare but worth hunting for. Others have higher deductibles but lower premiums. You have to balance cost vs. protection. If you’re older or have chronic conditions, go for lower deductibles. You’ll thank yourself later.

What’s Not Covered (And Why Claims Get Denied)

Most denied claims come down to one thing: misunderstanding what’s covered. Here are the top three reasons people get turned down:

- Pre-existing conditions: If you take medication for diabetes, asthma, or high cholesterol, that’s considered pre-existing. Even if you’ve been stable for years, insurers won’t cover refills abroad unless you bought a waiver-and even then, it’s not guaranteed.

- Refills for routine meds: Losing your pills? Running low? Too bad. Insurance won’t replace them. Only new, sudden illnesses count.

- Foreign prescriptions: U.S. pharmacies won’t fill a prescription from a doctor in Mexico or Thailand. You need a U.S.-licensed doctor to write a new one. If you try to use a foreign script, your claim will be denied.

According to the U.S. Travel Insurance Association, 43% of denied claims are because travelers didn’t understand the pre-existing condition rule. And 58% of medication claim denials happen because people expected coverage for their regular meds.

One Reddit user tried to refill their blood pressure meds after losing their supply in Canada. Their insurer denied the $300 claim. Why? “Maintenance medication.” Another user broke their ankle in Florida and got $1,200 in prescriptions covered-because it was a new injury, and they used a network pharmacy with proper documentation.

How to Get Your Meds Covered (Step by Step)

If you do need emergency medication abroad, here’s how to make sure you get reimbursed:

- See a licensed doctor first. In the U.S., you can’t get a prescription without seeing a doctor. Use urgent care, walk-in clinics, or telemedicine services offered by your insurer. Many top providers now let you video-call a U.S. doctor to get a prescription without leaving your hotel.

- Use a network pharmacy. Check your policy’s list of approved pharmacies. In the U.S., that’s usually CVS, Walgreens, or Rite Aid. If you go outside the network, you’ll pay full price upfront and wait weeks for reimbursement.

- Keep every receipt. You need the original receipt showing the drug name, dosage, price, and pharmacy. Also keep a copy of the prescription and the doctor’s note linking the med to your new condition.

- Submit claims fast. Most insurers require claims within 30 days. Use their app or online portal. Reimbursement usually takes 7-14 business days.

Travelers who follow these steps have a 92% approval rate. Those who skip the doctor or use foreign scripts? Only 67% get paid.

Which Providers Offer the Best Medication Coverage?

Not all travel insurance companies are equal. Here are the top three based on coverage, network size, and customer service:

| Provider | Max Medical Coverage | Medication Limit | Deductible | Network Pharmacies | Telemedicine? |

|---|---|---|---|---|---|

| IMG Global | $250,000 | Bundled | $0-$1,000 | CVS, Walgreens, Rite Aid | Yes |

| Seven Corners | $500,000 | $10,000 | $0-$2,500 | CVS, Walgreens | Yes |

| Allianz Global Assistance | $100,000-$250,000 | Bundled | $50-$500 | CVS, Walgreens | Yes |

Seven Corners leads in max coverage and customer service scores. IMG is best for simplicity and fast claims. Allianz has the widest global reach. Avoid credit card insurance-it rarely covers more than $1,000 for meds and often has huge deductibles.

Special Cases: Seniors, Chronic Conditions, and Medicare

If you’re over 55, you’re more likely to need medication coverage. In fact, people over 55 make up 48% of all medication claims-even though they’re only 32% of travelers. That’s because chronic conditions are more common, and meds are more complex.

Medicare doesn’t cover prescriptions outside the U.S. Not even in emergencies. Medigap plans (C, D, F, G, M, N) cover 80% of emergency care abroad after a $250 deductible-but only up to $50,000 total in your lifetime. And if you turned 65 after January 1, 2020, you can’t even buy those plans anymore.

For travelers with chronic conditions, the only real solution is a pre-existing condition waiver. Only 18% of standard plans offer them. You usually have to buy the policy within 14-21 days of your initial trip deposit. And you must be medically stable for 60-180 days before departure. It’s not easy, but it’s worth it if you need insulin, anticoagulants, or immunosuppressants.

What to Do Before You Leave

Don’t wait until you’re sick to figure this out. Here’s your pre-travel checklist:

- Bring at least 10-15% more medication than you’ll need.

- Carry a copy of your prescription in English, with generic names.

- Check if your meds are legal in your destination country (some are banned).

- Buy a policy with at least $50,000 in medical coverage and a low deductible.

- Confirm telemedicine and network pharmacy access.

- Save your insurer’s 24/7 emergency number in your phone.

And if you’re traveling with someone who has a serious condition-like heart disease or epilepsy-tell your insurer ahead of time. Some will give you a personalized plan or connect you with a travel nurse.

The Bottom Line

Travel insurance with medication coverage isn’t a luxury. It’s a necessity if you take daily meds or plan to travel to high-cost countries. The cost of a good policy? Around $50-$150 for a two-week trip. The cost of not having one? Could be $10,000 or more.

Don’t assume your health plan covers you. Don’t rely on credit card perks. Don’t think you’ll be fine if you just “bring extra pills.” Accidents happen. Illnesses strike. And if you’re stuck in a foreign country without your meds, you’ll wish you’d done the research.

Buy smart. Read the fine print. Know what’s covered-and what isn’t. Then pack your meds, your policy details, and your peace of mind.

Dylan Smith

December 16, 2025 AT 03:02Just lost my insulin in Barcelona and got stuck paying $400 out of pocket because I thought my insurance would cover it

Souhardya Paul

December 17, 2025 AT 22:30So many people don't realize travel insurance isn't health insurance. I've had friends try to get refills for their antidepressants overseas and get denied because it's 'maintenance'-like it's optional. You don't just stop taking these meds because you're on vacation. It's not a luxury, it's survival.

And the part about foreign prescriptions? That's brutal. I had to fly home early because my asthma inhaler broke in Thailand and the local clinic couldn't write a US-compatible script. Took three weeks and $2k to get it sorted.

If you're on daily meds, bring double. Always. And screenshot your policy's telemedicine number before you leave. I keep mine in my wallet next to my card.

Also, check if your meds are legal where you're going. I once had a friend get arrested in Dubai for carrying ibuprofen. Yes, really.

Kitty Price

December 19, 2025 AT 13:23Just bought my first travel policy after reading this 😭 thank you for the checklist. I'm diabetic and I used to think 'I'll just bring extra'-now I know that's not enough.

Also, I'm saving this to send to my mom who thinks 'it won't happen to me'.

Colleen Bigelow

December 21, 2025 AT 04:50Of course the system is rigged. Insurance companies don't want you covered. They make you pay for 'emergency' meds only so they can profit off people who panic and pay cash.

And don't get me started on how they use 'pre-existing condition' like it's a crime. You didn't choose to have diabetes. You didn't choose to have high blood pressure. But now you're a liability?

Meanwhile, the same companies give CEOs $20M bonuses while denying a $300 insulin refill. This isn't insurance. It's extortion with a website.

And why do they only accept CVS and Walgreens? Because they own them. It's all connected. You're being played.

Billy Poling

December 22, 2025 AT 00:22It is of paramount importance to underscore the fact that the majority of individuals who travel internationally and possess chronic medical conditions often underestimate the degree to which their domestic health insurance plans are geographically limited in scope. Furthermore, the assertion that standard travel insurance policies do not extend coverage to maintenance medications is not merely a technicality but a foundational principle of underwriting risk, which is predicated upon actuarial models that distinguish between acute, unforeseen medical events and chronic, predictable pharmaceutical requirements. In light of this, the suggestion that travelers should procure a minimum of 10-15% excess medication is not only prudent but statistically validated by data compiled by the World Health Organization's 2023 Global Traveler Health Survey, which indicates a 78% reduction in adverse outcomes among those who exceed the minimum recommended supply. Moreover, the utilization of telemedicine services facilitated by network providers such as IMG Global and Seven Corners represents a paradigm shift in accessible care delivery, particularly for elderly travelers who may face mobility constraints in foreign jurisdictions. The integration of these services with network pharmacies ensures continuity of care, which is not only ethically imperative but economically advantageous when compared to the average cost of an emergency room visit in the United States, which exceeds $1,500 as per the Centers for Medicare & Medicaid Services 2024 report. Therefore, it is not merely advisable but imperative that individuals with chronic conditions conduct a comprehensive review of their insurance documentation prior to departure, with particular attention to the delineation between emergency and maintenance pharmaceuticals, as well as the geographical parameters of network pharmacy access, in order to mitigate the potential for catastrophic financial exposure.

SHAMSHEER SHAIKH

December 23, 2025 AT 07:35As a diabetic traveler from India, I can tell you this article saved my life. Last year, I lost my insulin in Rome and had to call my insurer's 24/7 line - they connected me to a U.S. doctor via video call, who wrote me a new script, and I picked it up at a Walgreens nearby. No hassle, no drama.

But I carried 3 extra months of meds, and I had my prescription printed in English with generic names. That’s the real secret. Insurance is a safety net, not a crutch.

Also, always check your meds are legal in your destination. I once got stopped at customs in Dubai because my metformin was flagged as 'controlled substance' - turned out it was just a translation error. Had I not had the English script, I’d have been in deep trouble.

Travel smart. Don’t wait for disaster to strike. And yes, buy the policy. It’s cheaper than your next flight home.

Aditya Kumar

December 24, 2025 AT 06:39Yeah okay

Randolph Rickman

December 25, 2025 AT 17:51Biggest mistake I made? Thinking my credit card’s 'free' travel insurance was enough. Got hit with a $900 bill for antibiotics after a bad stomach bug in Mexico. Card said 'up to $1,000' - but only if I used their approved providers, which I didn't know existed.

Now I use Allianz. Low deductible, telemedicine works great, and they even helped me get a refill when my inhaler got crushed in my suitcase. No stress, no drama.

If you're on meds, don't gamble. Pay the $80 for a real policy. Your future self will hug you.

sue spark

December 25, 2025 AT 23:59I never realized how many people think their Medicare covers them overseas until I tried to help my dad after he got sick in Italy. He had a stroke and the hospital charged $12k. Medicare said no. His Medigap said $50k lifetime cap and they'd already used $45k on his 2018 trip to Japan.

He had to sell his old camera to pay part of it.

Please don't let this happen to your family. Read the fine print. Even if it's boring.

Tiffany Machelski

December 27, 2025 AT 00:01thanks for this i just bought a policy after reading this but i think i forgot to check if my insulin is covered under emergency or maintenance? oops