Every time you pick up a prescription, the drug you get isn’t just chosen by your doctor-it’s also decided by your insurance company. Behind the scenes, insurers use something called a preferred generic list to control costs and guide what medications you can get at the lowest price. These lists aren’t random. They’re carefully built, constantly updated, and have a direct impact on how much you pay out of pocket-and sometimes, even whether you get the drug your doctor originally prescribed.

How Preferred Generic Lists Work

Insurers don’t just cover any drug that’s FDA-approved. Instead, they organize medications into tiers, like levels in a pricing game. The lowest tier-Tier 1-is where preferred generics live. These are copies of brand-name drugs that work the same way but cost 80-85% less, according to the FDA. For example, levothyroxine (a thyroid medication) might cost $187 a month as a brand, but only $12 as a generic. That’s not a typo. That’s the power of competition: when six or more companies make the same generic drug, prices can drop by up to 95%.

Most insurance plans use a four-tier system:

- Tier 1: Preferred generics-$5 to $15 copay

- Tier 2: Preferred brand-name drugs or higher-cost generics-$25 to $50 copay

- Tier 3: Non-preferred brands-$50 to $100 copay

- Tier 4: Specialty drugs (like biologics for arthritis or cancer)-coinsurance or $100+

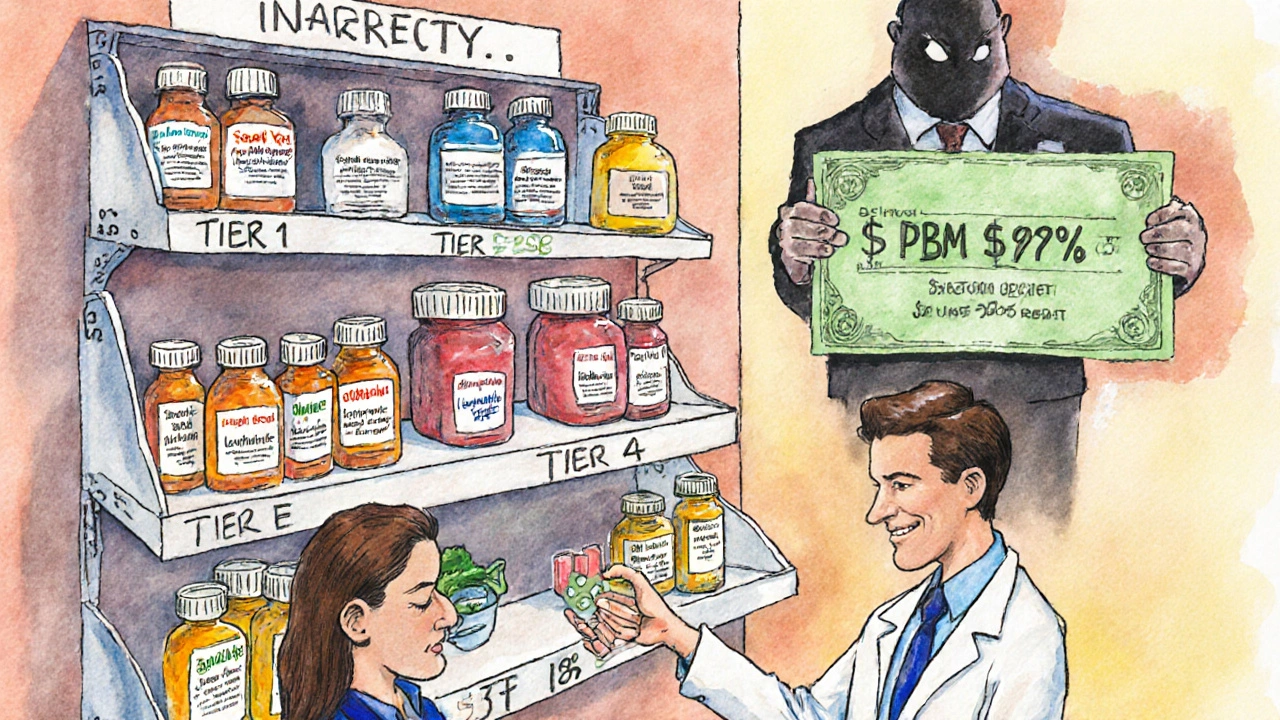

Insurance companies, through their Pharmacy Benefit Managers (PBMs) like CVS Health, UnitedHealth’s OptumRx, and Cigna’s Evernorth, negotiate deep discounts with drugmakers. For generics, they often buy directly in bulk. For brand-name drugs, they get rebates-typically 25-30%-but those rebates don’t always lower your copay. That’s why a brand and a generic can sit in the same tier with identical copays, even though the brand costs three times as much. Your out-of-pocket price stays flat, but the insurer pockets the difference.

Why Insurers Push Generics

It’s simple math. In 2023, generics made up 90% of all prescriptions filled in the U.S., but only 23% of total drug spending. That’s a massive gap. The U.S. generic drug market hit $122.7 billion that year, saving the system an estimated $1.68 trillion annually, according to Harvard’s Dr. Aaron Kesselheim. Without preferred lists, insurers would be paying far more for every pill.

Medicare Part D plans, which cover 65 million Americans, are required to use tiered formularies. In 2023, 92% of them used a four-tier structure. Commercial insurers aren’t far behind-98% of plans include preferred generics as their lowest-cost option. These lists aren’t just about saving money; they’re designed to nudge patients-and doctors-toward the most cost-effective choices.

But here’s the catch: not all generics are treated equally. Some drugs, like warfarin (a blood thinner), have a narrow therapeutic index. That means even tiny differences in how the drug is absorbed can cause problems. A 2022 study from the American College of Clinical Pharmacy found that 23% of doctors resist switching patients to generics for these drugs because of stability concerns. Insurers don’t always listen.

Where the System Gets Messy: Biosimilars and Co-Pay Cards

The biggest challenge today isn’t with old-school generics-it’s with biosimilars. These are the generic versions of complex biologic drugs like Humira, Enbrel, or Keytruda. They’re not exact copies (they can’t be, because they’re made from living cells), but they’re proven to work the same way. And they’re cheaper.

But here’s the problem: brand-name biologic manufacturers often offer co-pay cards that cut your monthly cost from $1,200 to $50. Biosimilar makers don’t. Why? Because they’re new players without the same marketing budgets. So even though Amjevita (the biosimilar to Humira) costs less on paper, your out-of-pocket bill might be higher if you lose your co-pay card.

In 2023, only 15% of eligible biologic prescriptions switched to biosimilars in the U.S.-compared to 85% in Europe. Why? Because U.S. formularies don’t always make biosimilars the easiest choice. And when insurers force the switch without warning, patients get caught off guard. One Reddit user reported paying $850 for Amjevita after Humira’s co-pay card disappeared-still a savings, but not the $100 they expected.

What You Can Do: Navigate the System

You don’t have to be passive. There are steps you can take to save money and avoid surprises.

- Check your formulary every year. During open enrollment, look up your meds on your plan’s website. A 2022 CMS study found patients who reviewed their formulary saved an average of $417 per medication.

- Ask your pharmacist. In 89% of states, pharmacists can automatically switch you to a generic unless your doctor writes “dispense as written.” Most patients don’t know this. Ask: “Is there a preferred generic for this?”

- Appeal if denied. If your insurer denies coverage for a brand-name drug your doctor says you need, you can appeal. Kaiser Family Foundation data shows 68% of these appeals succeed when your doctor provides medical justification.

- Use GoodRx or SingleCare. These apps often show cash prices lower than your insurance copay. Sometimes, paying out of pocket is cheaper.

But here’s the hard truth: 58% of Medicare Part D enrollees can’t even identify their plan’s tier structure. That’s why 31% end up with surprise bills. If you’re on multiple medications, it’s worth spending 45 minutes a year understanding your formulary. That’s the time it takes to save hundreds-or even thousands-of dollars.

The Bigger Picture: Who Controls Your Prescriptions?

Insurers and PBMs don’t make these decisions alone. Formularies are built by panels of doctors and pharmacists who review safety, effectiveness, and cost. But the final call? It’s often driven by rebate deals and market power. A 2023 Kaiser Family Foundation report showed that PBMs prioritize drugs that give them the biggest financial kickback-not necessarily the best for your individual health.

That’s why some doctors push back. Scott Glovsky, an insurance specialist, says: “Physicians know their patients best... it is unfortunate that physician decisions are questioned and altered by others who don’t understand unique patient circumstances.”

And there’s another layer: step therapy. Many plans require you to try and fail on a preferred generic before they’ll cover the drug your doctor prescribed. A 2022 AMA survey found 42% of physicians reported treatment delays because of this-especially in chronic pain cases.

Even worse, some insurers now use “accumulator adjuster” programs. These count your manufacturer co-pay cards toward your drug costs-but not toward your out-of-pocket maximum. So you might think you’re hitting your cap, but you’re not. That’s a hidden trap.

What’s Changing in 2025?

Things are shifting. Starting in 2025, Medicare Part D plans will be required to place biosimilars in the same tier as their brand-name counterparts. That’s a big deal. It could push biosimilar use from 15% to 45% in just a few years.

Also, the $2,000 annual out-of-pocket cap for Medicare Part D (starting in 2025) will make cost-sharing more predictable. That means insurers will have even more incentive to push low-cost generics, because patients won’t be paying more once they hit the cap.

Meanwhile, UnitedHealthcare has started testing “value-based formularies”-where tier placement isn’t just based on price, but on real-world outcomes. If a generic works better in practice than a brand, it moves up. It’s a small step toward putting patient results over rebates.

But the system is still broken in places. Transparency is still poor. Commercial plans score an average of 2.8 out of 5 for usability on formulary tools, compared to Medicare’s 4.2. And while generics save billions, inappropriate substitutions still cause 1.2% of adverse events-costing the system $4.7 billion a year.

So yes, preferred generic lists save money. But they’re not perfect. They’re a tool-used well, they help. Used poorly, they hurt.

Final Takeaway

Insurers prefer preferred generic lists because they work. They cut costs, reduce waste, and keep premiums lower. But they’re not neutral. They’re designed to influence behavior-yours and your doctor’s. The best way to protect yourself? Know your plan. Ask questions. Don’t assume your copay is fixed. And don’t be afraid to appeal. Your health-and your wallet-depend on it.

What is a preferred generic list?

A preferred generic list is a tiered formulary used by health insurers to encourage the use of lower-cost generic drugs. These lists rank medications by cost and effectiveness, placing the most affordable, therapeutically equivalent generics in the lowest tier-usually with a $5-$15 copay. The goal is to reduce overall drug spending while maintaining patient health outcomes.

Why do insurance companies prefer generics over brand-name drugs?

Generics cost 80-85% less than brand-name drugs on average, according to the FDA. When multiple companies produce the same generic, prices can drop by up to 95%. Insurers use preferred lists to steer patients toward these cheaper options, saving billions annually. In 2023, generics made up 90% of prescriptions but only 23% of total drug spending in the U.S.

Can I still get my brand-name drug if it’s not on the preferred list?

Yes, but it’s harder. If your doctor says you need a non-preferred brand, you can request an exception or appeal. About 68% of these appeals are approved when supported by medical documentation. Some plans also require you to try and fail on a generic first (called step therapy), which can delay treatment.

Are all generics the same? Can I trust them?

Yes. The FDA requires generics to be bioequivalent to brand-name drugs, meaning they must deliver the same amount of active ingredient within 80-125% of the brand’s absorption rate. Studies show 98.5% of generic approvals meet this standard. However, for drugs with narrow therapeutic indexes-like warfarin or seizure medications-some doctors prefer to stick with brands due to stability concerns.

Why are biosimilars harder to get than regular generics?

Biosimilars are cheaper versions of complex biologic drugs, but they don’t come with co-pay assistance cards that brand-name makers offer. So even if the list price is lower, your out-of-pocket cost might be higher. Also, many insurers don’t place them in the same tier as the original drug, and some use “accumulator adjuster” programs that don’t count your savings toward your out-of-pocket maximum.

How can I find out which tier my drug is on?

Check your insurer’s website during open enrollment. Medicare’s Plan Finder tool is reliable, but commercial plans often make it hard to find. Call your pharmacy or ask your insurer directly. You can also use GoodRx to compare cash prices-if they’re lower than your copay, paying out of pocket might be smarter.

Should I always choose the generic?

For most people, yes. Generics are safe, effective, and save money. But if you’ve had a bad reaction to a generic before, or your doctor has a strong reason to believe a brand is necessary (e.g., for epilepsy, thyroid, or blood thinners), speak up. You have the right to request an exception. Don’t assume the generic is always the best choice for you.

Next steps: Review your plan’s formulary before your next prescription refill. If your drug isn’t on Tier 1, ask your pharmacist about alternatives. If your insurer denies coverage, ask your doctor to file an appeal. It’s not complicated-but it’s worth your time.

james lucas

November 24, 2025 AT 19:50man i had no idea insurers were running this whole drug game like a monopoly board. i got switched from my thyroid med to some generic and my heart started racing like i drank 5 espressos. turned out the generic had a different filler that messed with my metabolism. took me 3 months and 2 appeals to get back on the brand. now i check my formulary like it’s my fantasy football draft. also, goodrx saved me $120 last month, wild right?

Michael Fitzpatrick

November 25, 2025 AT 06:06it’s kind of wild how the system works, honestly. you’d think the goal is to keep people healthy, but it feels more like a cost-per-pill spreadsheet with a doctor’s signature on it. i’ve seen friends get denied meds just because they didn’t try the $12 version first-even when their doctor said it could be dangerous. i get why insurers do it, but it’s still frustrating when your health becomes a line item. maybe one day we’ll stop pretending this is about care and just admit it’s about profit.

Danny Nicholls

November 25, 2025 AT 19:53yo if you’re on meds and not checking your formulary yearly you’re leaving money on the table 😅 i used to pay $90 for my blood pressure pill until i found out the generic was $7 with goodrx. my pharmacist even told me they can switch it automatically unless the doc says "do not substitute"-and i had no clue! now i ask every time. also biosimilars are the future but why no co-pay cards?? that’s just cruel. 🤦♂️

Robin Johnson

November 27, 2025 AT 09:47if you’re on multiple prescriptions, you’re already playing a game you didn’t sign up for. the key is knowing your leverage. ask your doctor to write "dispense as written" on the script if you’ve had bad reactions. file appeals-they work more often than people think. and never assume your copay is fixed. i saved $800 last year just by switching tiers and using cash prices. you don’t need to be a genius, just stubborn.

Rahul Kanakarajan

November 28, 2025 AT 03:02you people act like this is some conspiracy. it’s basic capitalism. if you can’t afford your meds, don’t be lazy and blame the system. get a job that pays more. or move to canada. or take the generic. it’s not rocket science. also, goodrx? that’s for people who don’t budget. grow up.

New Yorkers

November 28, 2025 AT 04:59we’re not talking about pills here. we’re talking about the soul of american healthcare. it’s not broken-it’s designed this way. they turn your body into a balance sheet, your pain into a rebate, your trust into a contract clause. and you sit there asking how to save $40 on your thyroid med like it’s a coupon clipping contest. the real question is: why are we still playing their game?

David Cunningham

November 29, 2025 AT 07:43we have this exact system in Australia but we call it the PBS. it works way better here-generics are automatic, co-pay caps are real, and no one’s hiding rebates. we still get brand-name drugs if needed, no step therapy nonsense. it’s not perfect, but at least we don’t have to be pharmacists just to fill a prescription. y’all got it rough.

luke young

November 30, 2025 AT 11:32just wanted to say thanks for writing this. i’ve been on 4 different meds this year and honestly felt like i was being gaslit by my insurance. this made me feel less alone. i checked my formulary today and switched to a cheaper generic-saved $60. small win, but it matters. also, my pharmacist was super helpful. we need more people like you sharing this stuff.

Jessica Correa

December 2, 2025 AT 00:18