When a drug’s patent expires, generic versions should flood the market-lowering prices, increasing access, and saving patients thousands. But in many cases, they don’t. Instead, brand-name drugmakers use a tactic called evergreening to delay generics for years, sometimes decades. It’s not illegal. It’s not always obvious. But it’s everywhere-and it’s driving up drug costs for millions.

What Evergreening Really Means

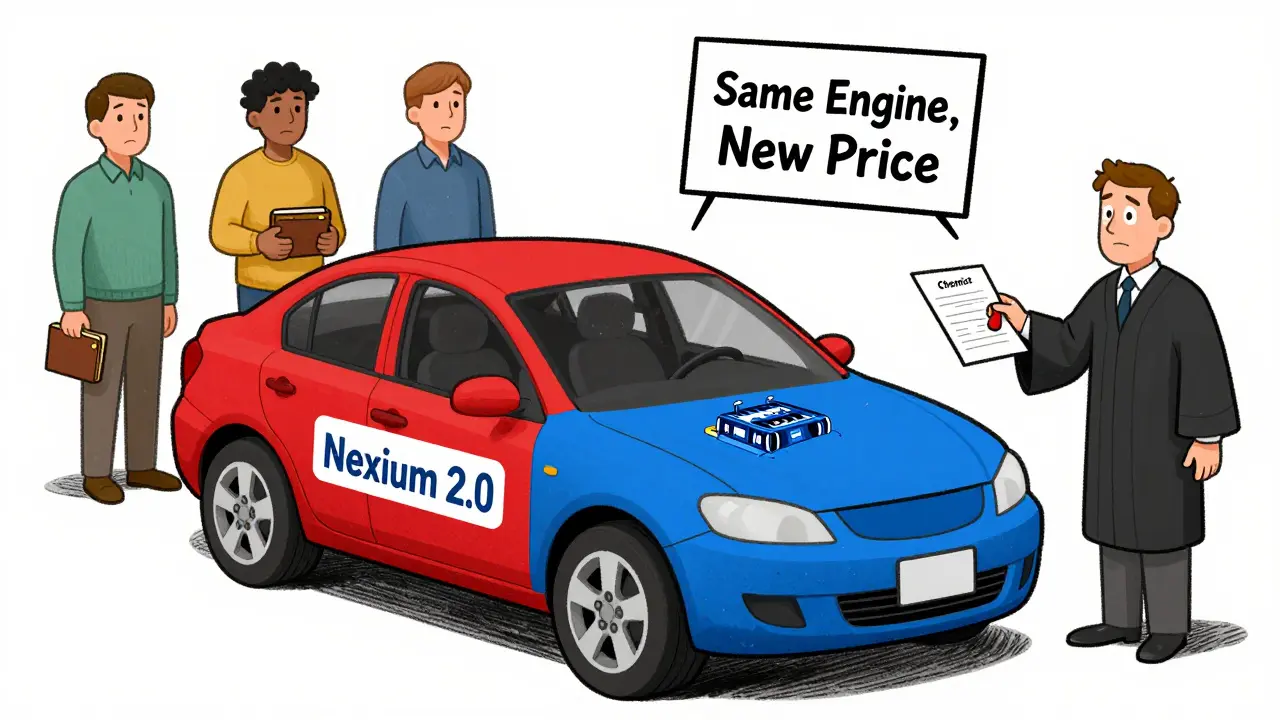

Evergreening isn’t about inventing new medicines. It’s about tweaking old ones just enough to get a new patent. Think of it like changing the color of your car and calling it a new model. The engine? Same. The performance? Nearly identical. But now you get another 20 years of monopoly pricing. The practice took off after the 1984 Hatch-Waxman Act in the U.S., which created a path for generic drugs to enter the market. In theory, this balanced innovation with affordability. In practice, drugmakers found loopholes. They started filing patent after patent-not for breakthroughs, but for minor changes: a new pill coating, a slightly different dose, a once-daily version instead of twice-daily. These aren’t improvements that help patients. They’re legal maneuvers to keep generics out.How It Works: The Playbook

Pharmaceutical companies don’t wait until their patent is about to expire. They start planning five to seven years in advance. Their teams-comprised of chemists, patent lawyers, and regulatory specialists-look for any small change that could qualify for a new patent. Here are the most common tactics:- New formulations: Switching from a tablet to a capsule, or from immediate-release to extended-release. Example: AstraZeneca’s shift from Prilosec to Nexium, a drug with nearly identical active ingredients but a new patent.

- Combination drugs: Adding a second, already-approved drug to the original. This creates a new patentable product-even if the original drug was already off-patent.

- Patent thickets: Filing dozens, even hundreds, of patents around one drug. AbbVie filed 247 patents on Humira, a biologic used for rheumatoid arthritis. Over 100 were granted. This creates a legal maze that generic makers can’t afford to navigate.

- Product hopping: Pulling the original drug off the market while pushing the new version. Patients are forced to switch, even if the old version worked fine. Insurers often won’t cover the old drug anymore, making generics the only affordable option-except they’re not allowed yet.

- Orphan drug and pediatric extensions: Getting extra exclusivity by testing a drug on children or for rare diseases-even if the drug was already widely used for common conditions.

The Real Cost: Patients Pay the Price

When generics enter the market, prices typically drop by 80% to 85% within the first year. That’s the power of competition. But evergreening blocks that. Take Humira: AbbVie’s drug generated over $40 million a day in revenue at its peak, thanks to patent extensions that delayed generics until 2023. Before then, patients paid up to $5,000 a month for a drug that could have cost $300. AstraZeneca’s strategy on six top-selling drugs-like those for diabetes and acid reflux-extended their patent life by over 90 years combined. That’s not innovation. That’s financial engineering. In Canada, the U.S., and Europe, patients with chronic conditions-diabetes, Crohn’s, psoriasis-are forced to choose between their medication and rent. A 2023 WHO report called evergreening a barrier to medicine access in low- and middle-income countries. In the U.S., the Federal Trade Commission sued AbbVie in 2022, calling Humira’s patent strategy “anticompetitive.” The case is ongoing.

Is This Really Innovation?

Developing a brand-new drug takes about 10 to 15 years and costs $2.6 billion on average. Evergreening? A fraction of that. A new formulation might cost $50 million to develop. The return? Billions in extra revenue. Harvard researchers found that 78% of new patents for prescription drugs were on existing drugs-not new ones. That means the patent system, meant to reward innovation, is now being used to protect profits. The same companies that claim they need patent protection to fund research are spending more on legal teams than on R&D for new molecules. Critics say the system is broken. Supporters argue that even small improvements deserve protection. But when the improvement is a coating that lasts 12 hours instead of 8, and the patient doesn’t feel any difference, is that really worth a decade of monopoly pricing?Regulators Are Fighting Back

The U.S. Patent Office has started rejecting obvious patent applications. The FDA has streamlined generic approval. The European Medicines Agency now requires proof of “significant clinical benefit” before granting extra exclusivity. The Inflation Reduction Act of 2022 gave Medicare the power to negotiate prices for the most expensive drugs. That’s a direct hit to evergreening’s profit model. If the government can cap prices, the financial incentive to stretch patents weakens. Still, companies adapt. Now they’re moving into biologics-complex drugs made from living cells. These are harder to copy. And they’re using nanotechnology and pharmacogenomics to patent genetic tests that predict who responds to a drug. If you need the test to get the drug, and the test is patented, you’re stuck with the brand.

What Can Be Done?

There’s no single fix, but progress is happening:- Patent reform: Limiting secondary patents to only those with clear clinical benefits.

- Transparency: Making all patent filings public and subject to independent review.

- Fast-tracking generics: Reducing legal barriers for generic makers to challenge weak patents.

- Public pressure: Patient advocacy groups are pushing lawmakers to act. In Canada, provinces are negotiating bulk drug purchases to bypass brand monopolies.

What Patients Should Know

If you’re on a brand-name drug that’s been on the market for over 10 years, ask your pharmacist: Is there a generic? If not, ask why. Check if the drug has been reformulated recently. Look up the patent status on the U.S. FDA’s Orange Book or Health Canada’s Drug Product Database. Sometimes, switching to a different drug in the same class can save hundreds or thousands. Don’t assume your doctor’s prescription is the only option. Ask about alternatives. Ask about cost. And don’t be afraid to push back.What’s Next?

Evergreening won’t disappear overnight. But the tide is turning. With more lawsuits, tighter regulations, and growing public outrage, the days of unchecked patent stretching are numbered. The next five years will decide whether the system serves patients-or just profits.Is evergreening legal?

Yes, in most cases, it’s legal. Evergreening exploits loopholes in patent law, not outright fraud. But courts and regulators are increasingly challenging it. The U.S. FTC sued AbbVie over Humira’s patent strategy in 2022, calling it anticompetitive. While not yet illegal, it’s under heavy scrutiny.

How long can a drug’s patent be extended through evergreening?

The original patent lasts 20 years from filing. Evergreening can add years through new patents, exclusivity periods, or legal delays. For example, Humira’s original patent expired in 2016, but due to 247 additional patents, generic versions weren’t allowed until 2023-seven years later. Some drugs have been protected for over 30 years total.

Do evergreened drugs work better than generics?

Rarely. Most evergreened versions have the same active ingredient as the original. Changes like extended-release coatings or new pill shapes don’t improve effectiveness. Studies show patients rarely notice a difference. The benefit is financial, not medical.

Can I get a generic version of an evergreened drug?

Only after the last patent expires. Generic makers can’t enter the market until all patents are cleared. That’s why some drugs have no generics for 15-20 years. Sometimes, generic companies challenge patents in court. If they win, generics can enter early. But legal battles are expensive and risky.

Which companies are known for evergreening?

AstraZeneca, AbbVie, Pfizer, and Johnson & Johnson are among the top users. AstraZeneca holds patents on six drugs with over 90 years of combined exclusivity. AbbVie’s Humira is the most extreme case-247 patents for one drug. These companies spend more on patenting than on developing new drugs.

How does evergreening affect drug prices in Canada?

Canada has stronger price controls than the U.S., but evergreening still delays generic entry. Even with provincial drug plans, patients may pay more for longer if generics are blocked. For example, a drug like Nexium was sold at high prices in Canada for years after the original Prilosec went generic. The delay directly increases out-of-pocket costs for those without full coverage.

Solomon Ahonsi

February 1, 2026 AT 16:33This is bullshit. Big Pharma’s been laughing all the way to the bank while people skip insulin doses to pay rent. They don’t invent-they just repackage and rip us off. 247 patents on one drug? That’s not innovation, that’s corporate greed dressed up in a lab coat.

George Firican

February 1, 2026 AT 19:33There’s a deeper tension here between the original intent of the patent system-rewarding true innovation-and its current function as a financial weapon. The law was never designed to let corporations extend monopolies by changing pill coatings or bundling old drugs with new ones. We’ve turned a mechanism meant to spur progress into a legalized extortion racket. The real tragedy isn’t just the price tags-it’s that we’ve normalized it. We accept this as the cost of doing business, when in reality, it’s the cost of losing our humanity.

Matt W

February 3, 2026 AT 10:28I’ve been on Humira for 8 years. My joints don’t hurt anymore. But I also know I’m paying $5K/month for something that could be $300. It’s not that I don’t want generics-I do. I just can’t switch without risking my health. This system isn’t just broken, it’s cruel.

Anthony Massirman

February 4, 2026 AT 19:25They’re literally patenting the color of the pill. 😒

Gary Mitts

February 5, 2026 AT 12:11clarissa sulio

February 7, 2026 AT 06:56Maybe if you Americans stopped expecting everything to be free we wouldn’t have this problem. Other countries don’t have drug prices this high because they don’t have the same innovation culture. We built this system-don’t blame the companies for playing by the rules.

jay patel

February 7, 2026 AT 13:59bro this is so real i live in india and we pay 10x less for same drugs but still cant get them because of patent crap. i saw my uncle pay 50k rupees for a month of meds that in usa cost 10000 but in india generic is 500. but even that is blocked by legal bs. companies just wait till indian generics are about to launch and file a patent in india too. its a joke. we need global patent reform not just in usa

Ansley Mayson

February 7, 2026 AT 15:37Why do people act surprised? The entire system is designed to extract value, not to help people. The FDA, Congress, the courts-they’re all paid off. The only thing that’s changed is the speed of the exploitation.

Hannah Gliane

February 7, 2026 AT 17:58Ohhh so now we’re mad because corporations are doing exactly what capitalism tells them to do? 😭💸

Patents = profit. Profit = survival. You want cheap drugs? Then stop expecting companies to be saints. Also, your ‘alternatives’ are probably just as dangerous. #PharmaHatesYou

Murarikar Satishwar

February 7, 2026 AT 21:54This issue is not just about patents-it’s about how we value human life versus corporate balance sheets. The fact that a drug that costs $50 million to reformulate can generate $40 million per day shows how distorted our incentives are. We need to separate R&D funding from monopoly pricing. Maybe a public fund could pay for innovation directly, so companies compete on quality and delivery-not on legal loopholes. It’s not anti-business-it’s pro-human.

Akhona Myeki

February 9, 2026 AT 17:24Let me be perfectly clear: the pharmaceutical industry operates under the explicit legal framework of the United States of America. The fact that you find their actions morally repugnant does not negate their legality. The solution lies not in demonizing corporations, but in reforming legislation through democratic processes. I am a citizen of South Africa, and I can tell you that we do not have the luxury of complaining-we have the responsibility to act.

Brett MacDonald

February 10, 2026 AT 15:28so like… the patent office is just a bunch of lawyers with no science background approving dumb stuff? and we’re surprised? 🤡

Sandeep Kumar

February 11, 2026 AT 10:52Generic drugs are for peasants. Real medicine needs brand trust. If you can’t afford it then you shouldn’t be taking it. The rich get better care. That’s how the world works. Stop whining

Vatsal Srivastava

February 12, 2026 AT 14:37You guys are missing the point. Evergreening is just the tip of the iceberg. The real problem is that we treat medicine like a consumer product. We don’t treat cars or electricity this way. Why medicine? Because we’ve been sold the lie that market forces always improve outcomes. They don’t. They just enrich the already rich.

Dan Pearson

February 14, 2026 AT 12:19Oh wow. So you’re telling me the same companies that made us pay $100 for a vial of epinephrine during the pandemic are now doing this too? 😭

Y’all really thought they cared about your life? Nah. They care about your credit card.